Group Nduom, majority shareholders of Blackshield Capital Management (formerly Gold Coast Fund Management) has expressed disappointment at the revocation of the company’s licence.

Hours after the Securities and Exchange Commission announced the revocation, Dr Paa Kwasi Nduom, Chairman and Chief Executive Officer of Group Nduom said his company’s request for help and announced plans to mitigate customers into a private-sector solution, was not considered by the regulator in arriving at its decision.

“We are disappointed that SEC would take this action without responding to the numerous request to assist Blackshield in retrieving funds owed by various government of Ghana entities,” the statement said.

The Securities and Exchange Commission (SEC) revoked the operating licences of 53 investment companies, Friday.

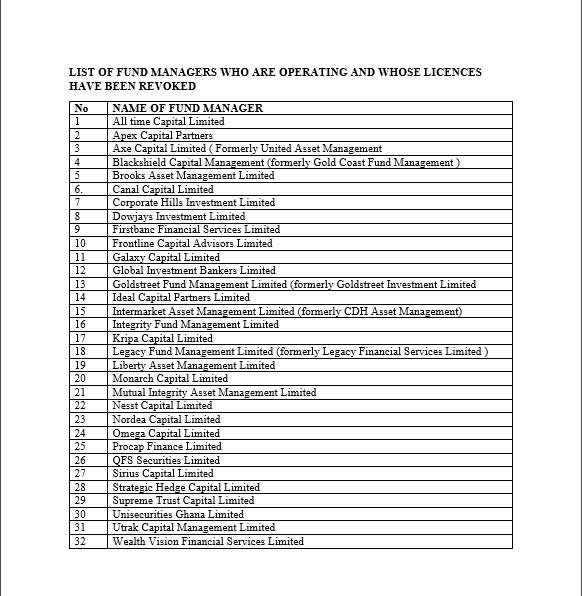

Blackshield Capital Management is among 32 operating firms whose licences have been revoked.

The revocation of the licences, according to the regulator, is to protect the integrity of the securities market and investors.

At a stakeholder meeting Friday before releasing a list of the affected companies, the Director-General of the SEC, Rev. Daniel Ogbarmey Tetteh, said troubled securities firms that have still not been able to address concerns raised about their operations over the years are among those affected by the action.

Twenty-one other firms were already out of business before the decision to revoke their licences was taken.

“These firms failed to inform clients about the risk that they are taking. They also failed to notify the Commission about their dealings,” said the Director-General of the SEC, Daniel Ogbarmey Tetteh, at the stakeholders’ meeting.

Read the SEC’s full statement on the revocation below.

This statement accompanying the revocation has been labelled as misleading by Dr Nduom who represents the interest of Blackshield Capital Management.

For instance, he debunked the assertion that 99.41% of Blackshield’s funds were placed in one investment vehicle.

The CEO of Group Nduom has therefore announced legal action to ensure the settlement of Blackshield’s client liabilities.

Below is a copy of the statement from Group Nduom

This evening, the Securities and Exchange Commission (SEC) posted a Notice of revocation of the licenses of various Fund Management Companies, including Blackshield Capital Management (Formerly Gold Coast Fund Management).

Groupe Nduom Limited, the entity representing the interests of the majority shareholders and founders of Blackshield, would like to note the following:

1.1. We are disappointed that SEC would take this action without responding to the numerous requests to,

a) assist Blackshield in retrieving funds owed by various Government of Ghana entities;

and b) review our plans to migrate customers into a private-sector solution to Blackshield’s liquidity problem.

1.2. SEC’s Notice No. SEC/PN/012/11/2019 regrettably includes a number of misleading and/or untrue statements, including the assertion that 99.41% of Blackshield’s funds were placed in one investment vehicle.

1.3. We will continue to pursue legal action to collect funds owed in settlement of Blackshield client liabilities.

1.4. In the meantime, we ask all stakeholders to remain calm as we all wait for more details from SEC on the way forward.

Sincerely yours,

Papa Kwesi Nduom

Chairman and CEO Groupe Nduom