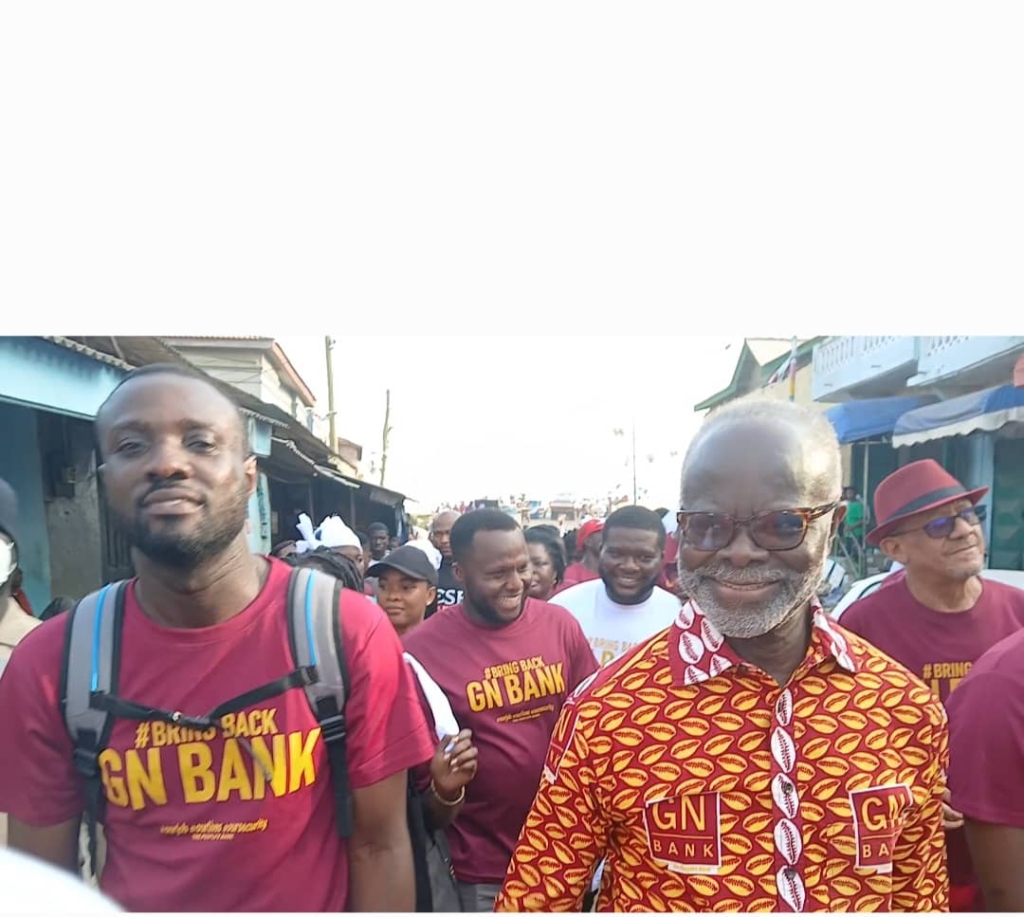

The streets of Elmina in the Central Region were charged with emotion on Monday, 2nd December 2024 as hundreds of demonstrators, led by Dr Paa Kwesi Nduom, took to the streets in a massive protest as part of the ongoing “Bring Back GN Bank” campaign.

The participants, from all walks of life, expressed their frustration over the collapse of GN Bank, calling for its reinstatement to support local businesses and restore jobs.

The demonstration saw protesters marching through some principal streets of Elmina.

Some of the demonstrators raised concerns about what they described as a “betrayal of trust” by traditional authorities and the government. They expressed their disappointment in the leadership of the Elmina traditional council.

In his address to the crowd, Dr Paa Kwesi Nduom, founder of Groupe Nduom and GN Bank, expressed his frustration over the circumstances that led to the bank’s closure in 2019.

He criticized the decision to close the bank, stating, “The collapse of GN Bank was not just about regulations. It was a targeted attack on Ghanaian entrepreneurship and innovation. But I remain hopeful that a new administration will see the value in bringing back the People’s Bank.”

Dr Nduom emphasized the impact of GN Bank’s closure on small businesses and rural communities, where the bank played a crucial role in providing accessible financial services. He added, “The restoration of GN Bank is not just about me. It’s about restoring hope and confidence in our local businesses and people.”

The protest in Elmina is part of a broader nationwide campaign. It has seen similar events across the country aimed at galvanizing public support and drawing attention to the bank’s significant contributions before its license revocation.

Dr Nduom expressed optimism about the bank’s potential reinstatement, saying, “The journey is far from over. With the support of the people, we will succeed.”

Background

In 2019, the Bank of Ghana revoked the licenses of 23 savings and loan companies and finance house companies, including the GN Bank.

The bank subsequently sought legal action challenging the revocation of GN Savings and Loans’ license by the Bank of Ghana (BoG).

But in January 2024, an Accra High Court presided over by Justice Gifty Addo Adjei, upheld the legality of the Central Bank’s decision, emphasizing the institution’s right to revoke the license due to governance deficiencies that rendered GN Savings and Loans unable to meet its debt obligations.

However, in a series of Facebook posts over the last months, the bank’s founder, Dr Papa Kwesi Nduom, hinted at what to expect regarding the defunct financial institution in the coming days.

Some of the bank’s assets in the 300 branches nationwide have been left to rot in some parts of the country.

Dr Nduom has in the past posted images and videos showing the current state of the bank’s assets.

One of the Facebook posts on May 1, 2024, read “Why #BringBackGNBank National Tour?

“We embarked on a tour of the country in 2018/2019 to save Ghanaian banks and jobs. They didn’t mind us. They rather fanned the flames that led to a run on our indigenous Ghanaian banks. Which bank in the world can survive panic withdrawals and state-sponsored liquidity crises?

Source: Eric Asante